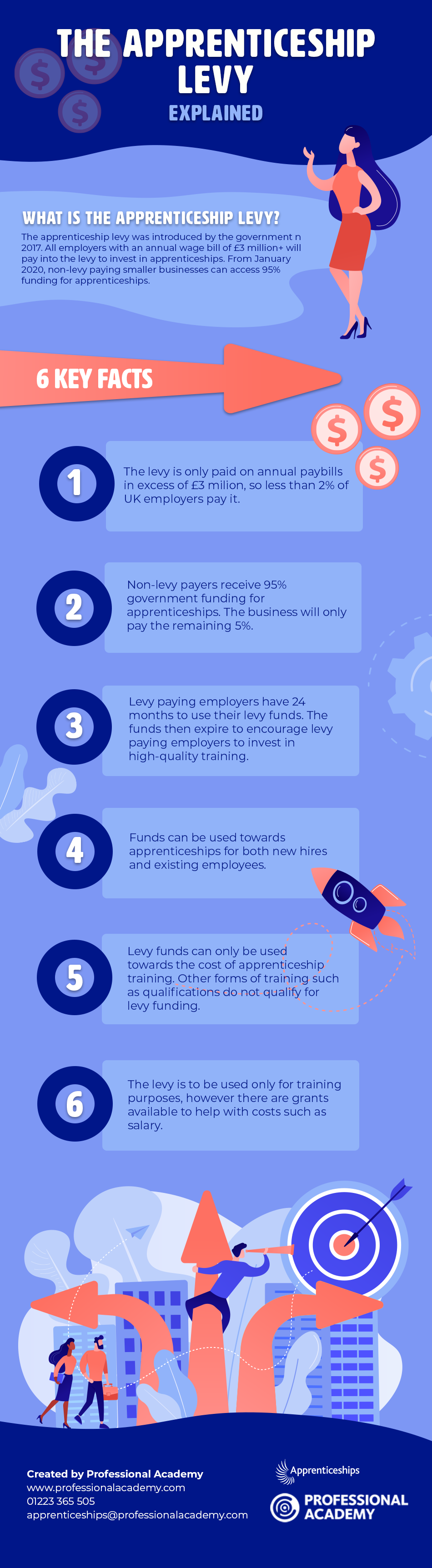

The apprenticeship levy was introduced by the government on April, 6th 2017. All employers with an annual wage bill of £3 million plus will pay into the levy, to invest in apprenticeships.

From January 2020 SMEs who are not paying into the apprenticeship levy can now access co-investment funding by the same online system as levy-paying employers. This means that you can choose from the full list of training providers and 95% of the funding for the training and assessment of your apprentice(not salary) will be paid by the Government with your business contributing the remaining 5%. Here is a breakdown of 6 key facts about the levy.

Want to learn more about the levy and how apprenticeships could help your business? Get in touch with our apprenticeships advice team today who will be happy to answer any of your questions!